2. From the left-leaning Brookings Institute:

The measure is a simple one: we calculate the average per-pupil funding levels of districts attended by poor students (those from families below the federal poverty level), compared to the funding of districts attended by non-poor students. Specifically, we calculate two weighted averages of the funding of all regular school districts in each state: one using the number of poor students in each district as weights, and the other using the number of non-poor students as weights. We adjust funding levels in each district using average wage levels in its local labor market...

Nationwide, per-student K-12 education funding from all sources (local, state, and federal) is similar, on average, at the districts attended by poor students ($12,961) and non-poor students ($12,640), a difference of 2.5 percent in favor of poor students...

The interpretation of these results will likely vary based on the reader’s expectations. Someone expecting to find widespread evidence of “savage inequalities” will be pleasantly surprised to learn that, on average, poor students attend schools that are at least as well-funded as their more advantaged peers. They might also be heartened by the fact that the gap in local funding of districts attended by poor vs. non-poor students has narrowed rather than widened during a period of rising economic inequality.3. The argument for using property tax to fund education:

A. Property tax is more stable than sales or income taxes (see graph in link #5)

B. Some states don't use sales or income taxes, alternative funding might be difficult

C. Untying property tax from school funding creates a disincentive for civic engagement. How?

Homeowners with school age children in public schools usually have a greater incentive to vote on issues that relate to public education when their property taxes are used to fund public education. Moreover, property-rich districts have higher property values and ownership, are less likely to vote on plans that recommend equity in school financing.4. From Ed.Gov

|

Annual Secondary Education Expenditures per Student |

|

Total U.S. Expenditures for Elementary and Secondary Education |

|

Total Expenditures per Pupil (for Fall Enrollment) |

|

Title I Grants for Disadvantaged Children |

5. The Property Tax - School Funding Dilemma (Lincoln Institute)

|

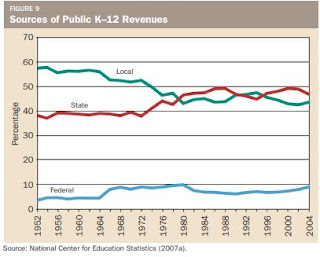

| Though, "K-12 education is funded by property tax" gives the wrong impression, that is not to say property tax is unimportant |

|

| There may be something to the stability argument of #3 |

\

|

| Many still cite outdated statistics on how much local and property tax contributes to school finance |

Quote:

Congress has reduced spending on public education since 2010, besides a large infusion of federal stimulus dollars for local school districts during and immediately after the Great Recession of 2007–2009. Between 2010 and 2016, the two primary sources of federal aid—Title 1 for high-poverty schools and special education aid—were cut by 8.3 and 6.4 percent respectively, after adjusting for inflation